Small Business Statistics UK Edition [2024]

Last Updated: February 9, 2024

In 2021, there were 5.6 million SMEs in the UK, which made up over 99% of the entire UK business population. These small business statistics UK are indeed something you should know in 2021.

We have prepared an in-depth analysis of the small business UK market for you, as well as some interesting stats and facts about businesses in the UK, so stay with us.

Small Business Statistics UK: Editor’s Choice

- The number of SMEs in the UK in 2021 was 5.6 million.

- In 2019, micro-businesses made up 96% of all SMEs UK, while small businesses took a 4% share.

- The average small business turnover in the UK was £2.6 trillion in 2020.

- As of January 2021, there were 5.6 million private sector businesses in the UK, compared to 5.9 million in 2020 — a fall of 6.5%.

- The average employment rate for SMEs in the UK was 61% in 2021.

- There were 4.2 million businesses with no employees in the UK in 2021.

- In 2020, SMEs were responsible for 50% of total revenue made by UK businesses.

- In 2019, the most lucrative SME sector was the real estate industry.

- Concerns for SMEs in 2020 were: pricing (27%), cash flow (24%) and technology (21%).

- In 2020, 5.3 million businesses in the private sector were in England.

Small Businesses in the UK by Size

What are SMEs? SMEs are small and medium-sized enterprises, or simplified — any business with fewer than 250 employees. What was the number of small businesses in the UK, again?

There were 5.6 million SMEs in the UK in 2021, which was over 99% of all businesses

SMEs can be separated into three smaller categories: Medium, Small and Micro Businesses.

Medium businesses have 50–250 employees, small ones with 10–50 employees, and micro-businesses are considered to have less than 10 employees.

In 2019, micro-businesses made 96% of all SMEs in the UK, while small businesses took only a 4% share

There were around 16 million people employed with small and medium-sized enterprises in the UK in 2019, compared with 27 million employees in total with all UK businesses.

- The average small business turnover in the UK was £2.6 trillion in 2020

- As of 1 January 2021, there were 5.6 million private sector businesses in the UK, compared to 5.9 million in 2020 — a fall of 6.5%

Now that we have separated SMEs by size, we can go over to the next segment to discuss UK businesses by employee size.

Small Business Statistics UK: Average Number of Employees

In the following table, you can see the 2019 SME-related statistics for the UK regarding employment and business turnover rates by enterprise size:

- The average employment rate for SMEs in the UK was 61% in 2021

- In 2019, there were 16 million people employed with SMEs in the UK

Out of those 16 million, 9 million were employed in micro-businesses (33% of employment), 4 million in small businesses (15% of employment), and around 3 million people employed in medium-sized enterprises in the UK (13% of employment).

- There were 4.2 million businesses with no employees in the UK in 2021

- In 2021, there were 3.2 million sole proprietorships (56% of the total), 2 million actively trading companies (37%), and 384k ordinary partnerships (7%) in the UK’s private sector

The following table demonstrates growth in the UK businesses in the private sector by the number of employees (expressed in thousands):

We can notice that this growth is due to rising numbers of non-employing businesses.

- The number of non-employing businesses in the UK has expanded by 2.2 million in the last 2 decades.

- Over this period, non-employing businesses represented 88% of total growth.

Small Business Statistics UK: Demographics

Check out the number of businesses in the private sector and their associated employment and turnover, by UK region, at the beginning of 2020. Numbers are based on businesses’ headquarters whereabouts.

- At the beginning of 2020, 5,3 million businesses in the private sector were in England, 370,000 in Scotland, 209,000 in Wales, and 148,000 in Northern Ireland.

- Simultaneously, most private sector businesses were in London with 1,1 million and the South East of England with 932,000.

How many businesses fail? What are businesses’ birth rates? And just what is meant by that, anyway?

The business birth rate is the volume of active businesses that began their affairs in the reporting year. On the other hand, the business death rate is the volume of companies that terminated trading in the reporting year.

- There were 390,000 business births in the UK in 2020.

- The number of business deaths in 2020 was 316,000, which is 20,000 less than in 2019.

What are women-led businesses? The ones controlled by women or management by a team dominated by women.

29% of SMEs were women-led in 2021, which is a 14% increase from 2019

The most common sectors of women-led businesses in 2019 were: education (32%), health (29%), other services (24%), accommodation and food service (21%), and administration and support (20%).

What about men-led and equally-led businesses?

- 11% of SME women were outnumbered in the management team; furthermore, 46% were fully men-led in 2019.

- In 2019, as well as in 2018, 24% of SMEs had an exact number of men and women in their management team.

Generally, small and medium-sized enterprises in the UK were trading longer than micro-businesses. The following table demonstrates the age of businesses in 2019.

| Type of SME | % of businesses aged 0-5 years | % of companies aged 21 or more years |

| Micro-businesses | 13% | 42% |

| Small businesses | 8% | 54% |

| Medium businesses | 5% | 63% |

- When it comes to businesses by sector, those 0-5 years were in accommodation and food services (26%), construction (16%). Those trading for 21 years or more were in the primary sector (78%).

- As for businesses by nation, aged 0-5 years were those in Northern Ireland (19%), followed by Wales (14%), then England (12%) and Scotland (11%).

According to Entrepreneurship statistics UK, the highest number of small business owners (31%) are in their forties.

Small Business Statistics UK: Growth Trends

We already covered employment growth in UK businesses, so it’s time to talk about other SME business growth trends. Keep in mind that these SME statistics UK are from the pre-COVID period.

In 2019, approximately 71% of small business owners intended to increase sales over the next three years

Most probable to have growth ambitions were SME employers in retail and wholesale (79%) and manufacturing (76%), while those in health (52%) and other services (59%) were least likely to target growth.

How much do they plan to grow their trading in the next three years?

Out of those aiming to grow, 20% of SMEs want to boost sales by 1–9%, 43% by 10–24%, and 16% by 25–49%

The most ambitious employers planned on growing by 50% or more, while 8% of SME employers weren’t capable of predicting their growth plans.

That leads us to another question. How do SME employers plan to increase their trading? The following picture presents the answers.

Those are the activities they plan to perform, but what are the main hardships to growth that small business owners face?

The main barriers to growth that SME employers reported were: competition in the marketplace (46%), red tape (43%) and taxation (40%)

Additionally, Brexit was notified as a growth obstacle by 26% of small business employers.

Now, what about business turnover growth. In other words, an increase in the value of their sales?

In 2019, growth in turnover was seen by 33% of SME employers, 44% had about the same turnover, and 19% reported a drop in turnover

Turnover growth was expected from those in information and communication, financial and real estate, administration and support (38% in each sector) and the manufacturing (37%) sectors. On the other hand, those most likely to experience a fall in turnover were ones in education (25%) and wholesale and retail (22%).

Impact of Small Businesses on the UK Economy

Small and medium-sized enterprises have a significant influence on the UK economy. True or false?

- In 2020, SMEs were responsible for 50% of the total revenue made by UK businesses.

- Before the COVID-19 crisis began, 80% of participants in McKinsey’s survey reported their SME revenue was stable or growing.

- In 2020, after COVID-19 took over, 80% of SME owners said their SME revenues decreased.

COVID-19 effects got 1 in 4 SME owners worried about non-payment of their loans. 24% were concerned about their capability to maintain workers, while 36% expressed concern about delaying growth projects.

Let’s take a look at the average profit of SMEs in the UK by size. Reasonably, the more significant the number of employees, the greater profit they produced.

In 2019, medium businesses in the UK had a median profit of £294,000

Small businesses had a median profit of £56,000, micro-businesses of £15,000 and businesses without employees £6,000. If we look at all UK SMEs, their median profit in 2019 was £8,000.

Like previously, the bigger the number of employees, the greater the company’s chances of reporting a profit.

In 2019, 88% of medium businesses reported that they made a profit

86% of small businesses reported profiting, 83% of micro-businesses and 82% of companies without employees. Altogether, 82% of SMEs made a profit in the UK in 2019.

Popular Industries for Small Businesses in the UK

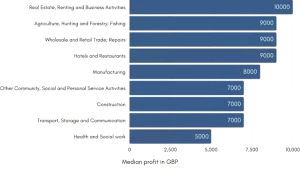

In 2019, the most lucrative SME sector with the highest average profit of £10,000 was the real estate industry

To see other profits by SME sectors, check out the picture below.

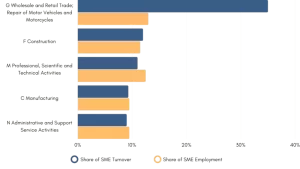

The next picture by gov.uk presents industrial sectors with highest SME turnover and employment, as a percentage of total SME employment and turnover.

Wholesale and Retail Trade and Repair of Motor Vehicles and Motorcycles accounted for 35% of all SME turnover UK in the private sector and 14% of all SME employment

List of Small Businesses in the UK

Based on a survey of employees, The Sunday Times made a list of the best small businesses to work for in the UK in 2020; check out the top 10.

| Brightstar Financial | Mortgage lender |

| Pure Planet | Renewable energy provider |

| Step Change Outsourcing | Call centre |

| RedRock Consulting | Recruitment |

| plan.com | Mobile data provider |

| SourceBreaker | Recruitment software |

| Equilibrium Asset Management | Asset Management |

| Clarion | Legal firm |

| Oscar | Recruitment |

| The Furniture Practice | Furniture consultancy |

Challenges of Small Business Owners

Take payments conducted a survey in which 1000 SME owners took part, unveiling the struggles and weak points of their business.

The top three concerns for SMEs in 2022 are: continuing coronavirus restrictions (27%), environmental and sustainability challenges (22%) and societal changes (11%)

What’s the biggest challenge for most businesses when going online, you might wonder?

According to answerout.com, the majority of businesses’ most significant challenge when going online is developing a proper plan since they don’t know their primary focus. They are divided between Social Media Marketing, Search Engine Marketing, and Search Engine Optimisation.

Wrap Up

It is certainly troubling that the UK economy’s backbone is, like everything else, severely affected by the COVID-19 outbreak. However, SME owners’ pleas for help should not be overlooked so easily. Many people consider SME businesses to be that backbone, and these small business statistics UK certainly support that claim.

If nothing else, it is reassuring that UK government is taking actions to help small, self-employed and large businesses, as well as any businesses who are affected by coronavirus restrictions, with a healthy financial support program.

![How to Sell on Depop in the UK [2024 Guide]](https://cybercrew.uk/wp-content/uploads/2023/06/Selling-on-Depop-UK.png)