FreshBooks vs QuickBooks — UK Comparison

Last Updated: March 30, 2023

FreshBooks and QuickBooks are cloud-based accounting platforms geared towards small businesses and sole proprietors. Both are fully-fledged, double-entry accounting solutions designed to help UK small businesses streamline their accounting process and stay on top of their finances.

However, while they both serve a similar purpose, each platform comes with its own unique set of features and benefits.

In this FreshBooks vs QuickBooks comparison, we will see how the two platforms differ in terms of features, pricing, and support and help you decide which one is the right option for you.

What is FreshBooks?

Founded in 2003, FreshBooks initially started out as invoicing software but grew to become a comprehensive accounting solution that handles everything from invoicing and time tracking to online payments and expense management.

FreshBooks is based in Toronto, Canada and is currently used by over 30 million people in 160+ countries worldwide, making it one of the most popular accounting platforms on the market.

FreshBooks announced its official launch in the UK in 2019. To mark the launch, the company introduced a new suite of features aimed to help UK-based small businesses grow and succeed, such as HMRC-approved Making Tax Digital for VAT, direct debit payments, and a mileage tracker.

What is QuickBooks?

QuickBooks Online is a cloud-based accounting software developed by Intuit, one of the largest financial software companies in the world.

Known as a market-leading small business accounting software, QuickBooks was released back in 1983 and was one of the first accounting solutions to move to the cloud. The web-based version of the QuickBooks software was first launched in the US in 2001, but it didn’t enter the UK market until a decade later, in 2011.

QuickBooks Online is currently the go-to accounting solution for small businesses and freelancers in the UK, offering excellent tax planning support, as well as features like invoicing, expense tracking, inventory management, and more.

FreshBooks vs QuickBooks: Key Features

Invoice Creation

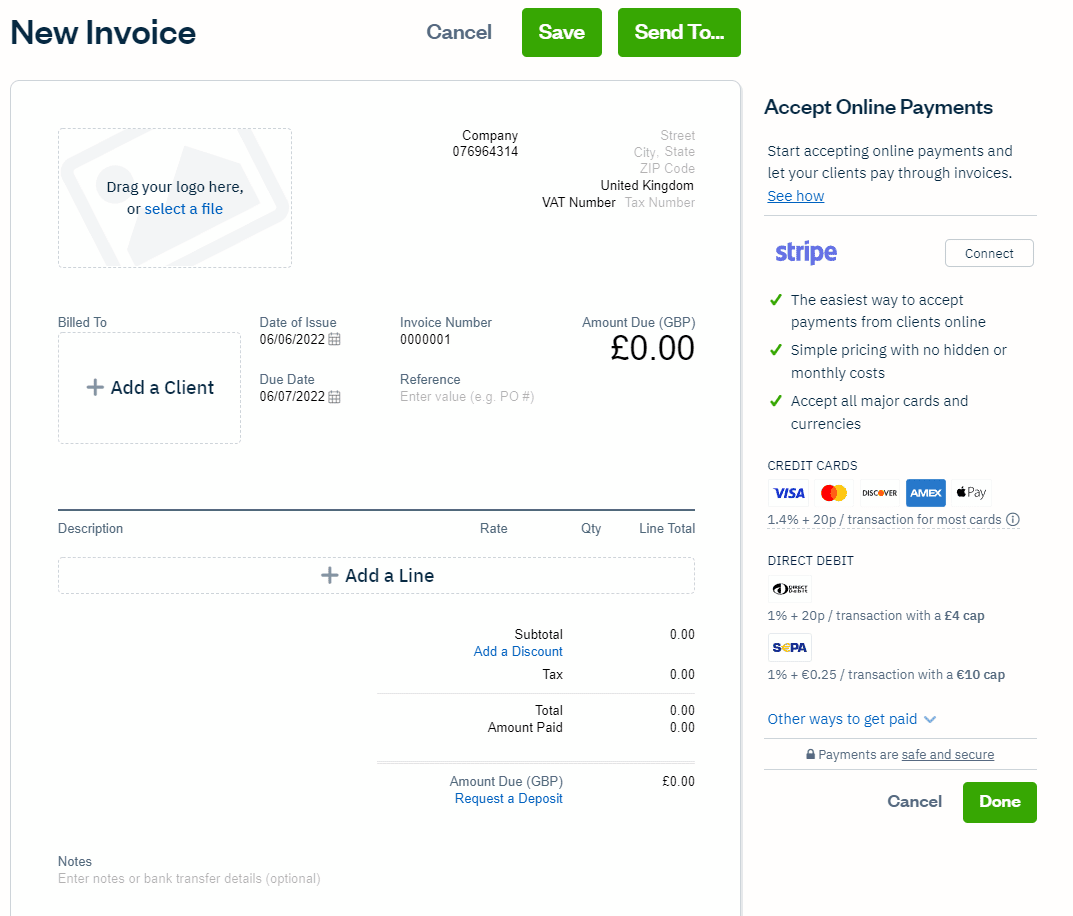

FreshBooks has an intuitive and straightforward invoice creation process.

The platform removes much of the workload associated with invoicing by letting you set up recurring invoices on clients that are billed regularly. In addition, FreshBooks lets you set up and apply automatic late fees when an invoice becomes overdue and automatic payment reminders to prompt your clients to pay up.

When creating an invoice, you can also brand it with your company logo, add a personalised message, and choose from a range of customisation options. What’s more, FreshBooks lets you add time tracking data to invoices if you mark your hours as billable.

Once you’ve connected your account with Stripe, you can also create pay-enabled invoices, allowing your clients to pay directly from the invoice with a credit or debit card.

The best part is that you can handle everything directly from the invoice creation window, with no need to switch back and forth between different sections of the platform.

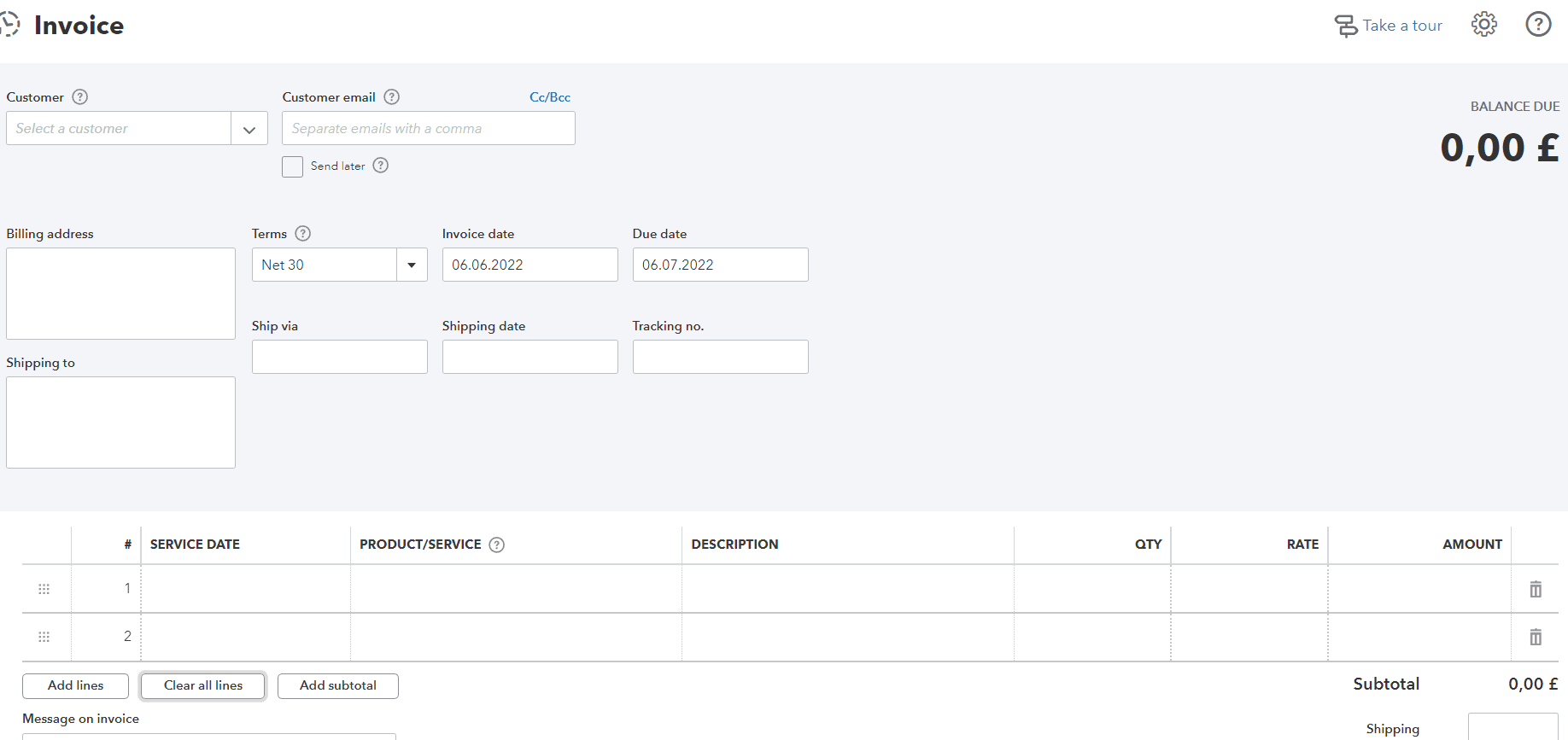

QuickBooks Online offers many of the same automation and customisation options, allowing users to quickly and easily create professional-looking invoices. However, compared to FreshBooks, the process is not as smooth or intuitive.

For instance, everything has to be written in separate sub-menus, making invoicing a bit more time-consuming and tedious. Invoice previews are a bit more complicated as well, requiring users to convert invoices into PDF documents to see how they look before sending them.

In addition, with QuickBooks Online, adding chargeable hours to a client’s invoice is only available on higher-priced plans.

Overall, while both FreshBooks and QuickBooks Online have similar invoicing capabilities, FreshBooks takes the lead with its more intuitive interface and ease of use.

Expense Tracking

Both FreshBooks and QuickBooks Online allow you to connect your bank account — meaning your expenses will be automatically imported, removing the hassle of having to enter them manually.

Connecting your bank account will also allow you to separate your expenses into different categories, which can be extremely helpful come tax time.

Furthermore, both accounting platforms offer mobile receipt scanning, allowing you to capture receipt data for expenses automatically, which can be of great help if you want to keep track of business expenses while on the go.

However, FreshBooks makes expense tracking slightly easier with its visually-appealing interface. The platform colour codes recently updated expenses, making it easy to see your expenses at a glance and quickly identify any discrepancies.

Creating a new expense with FreshBooks is similar to its invoice creation process and is also slightly more intuitive than with QuickBooks.

So, while both platforms offer similar expense tracking features, FreshBooks again has a slight edge over QuickBooks Online, thanks to its intuitiveness and user-friendliness.

Time Tracking

One area where FreshBooks really stands out is time tracking.

The platform has a built-in time tracking software that ensures every hour worked is accounted for and billed. You can clock in and out instantly by using the built-in timer or enter your hours manually on a daily, weekly, or monthly basis.

Moreover, you can assign the time worked to different clients and projects and generate invoices directly from the hours logged. Most importantly, time tracking is unlimited and available on all plans, including the cheapest one.

With QuickBooks Online, you will need to subscribe to the Essentials plan or up to be able to track time. If you’re on the cheapest, Simple Start plan, you won’t be able to track your hours or bill your clients for the time worked, which can deter users not willing to subscribe to one of the platform’s higher-priced plans.

Tax Planning

QuickBooks is one of the leading cloud-based accounting tools for tax planning. The platform offers a useful tax estimate tool that provides freelancers with a rough estimate of their Income Tax and National Insurance contributions based on data entered (such as invoices and expenses).

Although the estimate isn’t completely accurate, it can still be of huge help when submitting your Self-Assessment tax return, as you can have a good idea of how much you need to pay in advance.

QuickBooks Online is also fully Making Tax Digital compliant and HMRC-recognised and allows users to send their VAT returns straight to HMRC without ever leaving the software.

FreshBooks is also HMRC approved and fully Making Tax Digital compliant, but, compared to QuickBooks Online, its tax planning features are a bit limited. FreshBooks offers only Making Tax Digital VAT return filing and lacks an Income Tax estimate tool, making tax planning a bit more difficult for freelancers who use the platform.

Payroll

QuickBooks Online offers payroll as an extra optional feature on all of its pricing plans. For a small monthly fee, the payroll add-on will allow you to pay employees, manage employee benefits, and generate payslips, all in one place.

There are two payroll plans to choose from, Standard Payroll and Advanced Payroll, available for £4 and £8 a month, respectively.

The Standard Payroll plan includes features like

- HMRC recognised payroll

- Weekly and monthly payments

- Automatically generated payslips

- Calculations of statutory maternity, paternity, and sick pay

- Automatic pension submissions to Nest

The Advanced Payroll plan allows you to pay employees on any frequency, calculates up to five statutory payments, and includes employee portal and HR features, among other things.

On the other hand, FreshBooks lacks a payroll add-on, meaning you will have to integrate a separate payroll tool into the platform if you want to use it to pay your employees.

So, if running payroll is one of the features you are looking for in your accounting software, QuickBooks Online is a much better choice.

Integrations

Both accounting platforms can integrate with a range of third-party apps, but QuickBooks Online is in the lead with 650+ app integrations. These can help you automate a range of business tasks and save you countless hours of manual data entry.

For instance, integrating PayPal will allow you to import all your PayPal transactions into QuickBooks Online seamlessly. Similarly, integrating Shopify will let you automatically update your inventory, sync sales and customers, and track your eCommerce performance.

Other premium QuickBooks Online integrations include HubSpot, Salesforce, Bill.com, DocuSign, and more.

FreshBooks can also integrate with a range of apps but lags behind QuickBooks Online, with only 100+ apps to choose from. However, it does have a few notable integrations, such as Gusto, G Suite by Google Cloud, Stripe, and Fundbox.

Mobile Apps

QuickBooks Online and FreshBooks both have mobile apps available for iOS and Android devices.

Both mobile apps work similarly, allowing users to create invoices, manage expenses, and view reports on the go. The mobile apps are also fairly similar in terms of functionality and user-friendliness and have interfaces that resemble their web counterparts.

Perhaps the most notable feature of both mobile apps is the mileage tracker, which allows users to claim tax relief on business trips and separate personal from work-related trips with a single swipe.

Pricing

FreshBooks Pricing

FreshBooks offers three plans to choose from, ranging in price from £11 to £30 per month. The cheapest, Lite plan allows up to five billable clients. It includes basic features like unlimited invoicing, unlimited expenses, Direct Debit payments, and VAT return filing for HMRC Making Tax Digital.

Next up, the Plus plan supports up to 50 billable clients and includes more advanced features, like double-entry accounting reports and the ability to set up recurring invoices.

Finally, there’s the Premium plan that removes the client limit and includes everything FreshBooks has to offer, including priority support.

Note that, for each additional client you add, FreshBooks will charge you £7 per person per month.

| Plan | Price | Key Features |

|---|---|---|

| Lite | £11/month |

|

| Plus | £19/month | Everything in the Lite plan, plus:

|

| Premium | £30/month | Everything in the Plus plan, plus:

|

In addition, FreshBooks offers a custom Select plan that’s designed for larger businesses with complex needs. The price of this plan depends on the number of clients and features you need, so you’ll need to reach out to FreshBooks’ support team for a custom quote.

QuickBooks Pricing

QuickBooks Online is slightly more expensive than FreshBooks. There are three QuickBooks plans to choose from, ranging from £12 to £32 a month.

The cheapest plan, Simple Start, includes features like invoicing, expense tracking, bank reconciliation, and VAT return filing.

If you need more advanced features like the ability to import bills from suppliers and track employee time, then you’ll need to upgrade to the Essentials plan, priced at £22 per month.

The Plus plan supports a maximum of five users and includes advanced features like the ability to set up and manage stock and see project profitability.

| Plan | Price | Key Features |

|---|---|---|

| Simple Start | £12 |

|

| Essentials | £22 |

Everything in Simple Start, plus:

|

| Plus | £32 |

Everything in Essentials, plus:

|

Unlike FreshBooks, QuickBooks Online also has a dedicated self-employed plan designed for sole traders who are not VAT registered.

The Self Employed plan costs £8 per month and includes the following features:

- Prepare a Self-Assessment tax return

- Get Income Tax estimates

- Automatically import bank transactions

- Manage income and expenses

- Track mileage for business trips

- Separate personal and business transactions

FreshBooks lacks a dedicated self-employed plan, making QuickBooks Online a better choice for freelancers and sole traders. In addition, QuickBooks Online doesn’t impose any client limits on any of its plans, while FreshBooks removes the client limit only on its most expensive, Premium plan.

In addition, both platforms lack a free plan but offer a free 30-day trial, allowing users to test out the features before committing to a paid subscription.

Support

Both platforms offer free UK phone support, but with one crucial distinction. FreshBooks’ support team is only available during North American business hours, from 8 am to 8 pm ET, time, which some customers may find limiting. In addition to that, Freshbooks offers support via email and an extensive knowledge base filled with helpful articles and video tutorials.

QuickBooks, on the other hand, offers phone support during UK business hours, from 8 am to 7 pm GMT. The platform also offers a live chat, which is a big plus for small businesses that need assistance outside of regular business hours.

The live chat is available from 8 am to midnight on weekdays and from 8 am to 6 pm on weekends. In addition to that, QuickBooks has an extensive online help centre with step-by-step guides and video tutorials to help users get the most out of the software.

Overall, both platforms offer decent customer support, but some users may prefer QuickBooks because of the more practical hours and the live chat option.

Wrap Up

While both FreshBooks and QuickBooks are excellent accounting software solutions for small businesses in the UK, there are some key differences that may make one or the other more appealing, depending on your specific needs.

In this FreshBooks vs QuickBooks comparison, we’ve outlined the main pros and cons of each below to help you decide which one is right for you.

If you are looking for slick and intuitive accounting software with advanced invoicing and time tracking capabilities, FreshBooks is a great option. However, if you need an all-in-one solution that can also handle your payroll, taxes, and inventory tracking, QuickBooks Online is the way to go.

Do you have any experience using FreshBooks or QuickBooks? Let us know in the comments below.

FAQ

Yes, FreshBooks is often praised for its user-friendly interface, and indeed, it is one of the simplest accounting solutions to use. QuickBooks has a slightly steeper learning curve but is also fairly easy to use, especially if you’re already familiar with accounting concepts.

No, FreshBooks and QuickBooks are two different accounting solutions. They both offer similar features but have different interfaces, pricing models, and levels of support.

![How to Sell on Depop in the UK [2024 Guide]](https://cybercrew.uk/wp-content/uploads/2023/06/Selling-on-Depop-UK.png)

![Free Appointment Scheduling Software — UK Top Picks [2024]](https://cybercrew.uk/wp-content/uploads/2022/07/Free-Appointment-Scheduling-Software.png)