Debt Statistics UK Edition [2024]

Last Updated: February 9, 2024

The UK economy is the fifth-largest national economy worldwide, yet, even so, its debt is continually rising. The UK Government has spent billions to support small businesses in a time of need during COVID-19 lockdowns.

Nearly 9 million people have borrowed money due to the pandemic. Naturally, this has become a trending topic among residents in the UK currently, so before you go into debt, let us acquaint you better with the debt statistics UK.

Top 10 Debt Statistics UK

- The average debt in the UK was over £1.7 billion at the end of November 2021.

- The average total debt per household in 2021 was £63,112.

- Unsecured debt from personal loans was estimated at £208 billion in 2019.

- As stated in UK personal debt statistics, 63% of UK adults had personal debt in 2019.

- In 2018, every household debt grew by nearly £1000 compared to the previous year.

- Only 9% of the household debts are financial debts, while the rest are property debts (as of 2019).

- The fixed rate for a 2-year mortgage was 1.79%.

- According to personal debt in the UK, the average total debt per adult was £32,053 in 2021.

- In December 2021, interest for credit card loans was 21%.

- Little over half of the UK’s adult population living in large towns have debt.

Personal Debt Statistics in the UK

The most frequent reasons for personal debt in the UK were poverty, decreased incomes, and bankruptcy.

As of November 2021, the average debt in the UK was £1,754.3 billion

This kind of debt is created by secured as well as unsecured lend and credit card loan.

- 16% of the adult population in the UK is facing a debt problem.

- The debt problem has enlarged to 28% for single parents.

Debt problems occur primarily in large towns like Wales and the North of the UK. About 313 people a day were declared insolvent or bankrupt in England or Wales from August to October 2021.

The unsecured debt was £3,838 per adult in November 2020

According to Debt statistics in the UK, unsecured debt per adult increases twice as much as a secured one.

- Unsecured debt from personal loans was estimated at £208 billion in 2019.

- Personal loans have reached up to £390 million in the first quarter of 2020.

- Almost 63% of the adult population in the UK entered 2020 with personal debt.

As we can see, over half of the UK population have entered 2020 with personal debt. We can’t help but wonder, are they planning on paying off their debt? 11.5% of respondents in Statista’s survey about Savings statistics UK plan to spend their savings to pay off their debt.

As shown in debt statistics in the UK 2020, young British are more exposed to an unsecured debt due to less payment time.

- Based on the UK’s average debt report, interest for credit card loans was 21% in December 2021.

- £2,114 was the average amount recorded for catalogue debts in 2019.

- The home credit debt was over £200 billion in November 2020.

As specified by average debt statistics in the UK, credit card loans, while mostly unsecured, mainly cover the cost of bills, a new car, or a new piece of furniture.

- The annual growth rate of overdrafts in 2019 increased by 6% compared to 2018.

- Close to 19 million Brits practice overdrafts every year.

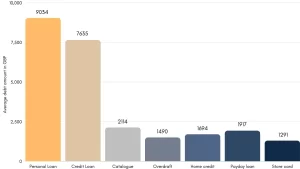

Below shown are debt statistics in the UK by type in 2019.

How much debt does the average person have in the UK?

The average loan per adult was £32,014 in December 2020

Based on personal debt in the UK, this is about 107.5% of the average yearly income.

- In the UK, consumer credit loans came to £21 billion in the last quarter of 2020.

- Students in the UK loaned over £17 billion every year.

In the UK, 1.5 million students have reached a total loan of £141 billion in the first quarter of 2021.

Debt Statistics UK: Household Debt Statistics

UK household gross debt is forecast to grow 8% in the next six years. Check out the following statistics.

- In 2018, every household debt grew by £886 compared to the previous year.

- 54% of the UK’s adult population living in large towns have debt.

- 128% was the average household debt by income in 2020.

According to debt statistics in the UK in 2020, household debt is estimated to rise close to £2 trillion by 2025.

- The average credit card debt per household in November 2021 was £2,118.

- Total debt by household, including mortgages, was £60,720 in 2020.

- The fixed-rate for a two-year mortgage was 1.79%.

How big of an issue is the debt in the UK?

7% of households in the UK reported debt as an outstanding problem

Debt reporting has decreased in proportion to rising revenues. According to debt statistics, low-income households are more exposed to debt problems.

- From April 2016 to March 2018 91% of household debt was property debt.

- Just 9% of household debt was financial debt.

Total property debt was £1.16 trillion from April 2016 to March 2018, while the student loans rose financial debt by £7 billion.

Debt Statistics UK: National Debt Statistics

According to the UK Debt Statistics, the national debt is on the rise, which means it surpasses the economy. In 2020, the UK government debt reached over £2 trillion due to the Covid-19 pandemic.

Have you ever wondered what percentage of the UK is in debt?

- The Government debt gross was £1,876.8 billion in 2020.

- The general UK Government deficit (or net borrowing) was £63 billion in the last quarter of 2020.

The budget deficit begins from supporting businesses, lockdown, and virus measures. This debt is proportional to 84.6% of GDP in the UK.

The UK’s national debt in 2019 is equivalent to about 85.35% of the GDP

National debt as a percentage of GDP in the UK is the most crucial economic segment.

Wrap Up

Here’s hoping we have helped you familiarise yourself with UK debt statistics and make you feel more at home with your outstanding debt or have made you feel more confident if you have yet to make a choice.

Nowadays, it seems crucial to know how to save your money and manage your bills. It’s time to take control into your own hands.

![How to Sell on Depop in the UK [2024 Guide]](https://cybercrew.uk/wp-content/uploads/2023/06/Selling-on-Depop-UK.png)

meubelen vilvoorde

August 3, 2021 at 3:25 pm

Thanks.

Milica Strugar

August 4, 2021 at 10:26 am